×

![]()

Who can be a member of SUCC?

-

REGULAR MEMBERSHIP - all natural persons who are Filipino citizens, of legal age, with the capacity to contract and possess all the qualifications and none of the disqualifications enumerated in the By-laws; and fall into the following categories:

-

Full-time employees of:

- Silliman University (SU)

- Silliman University Medical Center Foundation, Inc. (SUMCFI),

- SUCC Multipurpose Cooperative

- Silliman University Church

- Silliman University Extension Program and their spouses even if not employed by the university)

- All gainfully employed children of existing SUCC members

- All Silliman University Alumni who are gainfully employed, and are residing in the Philippines

- The above members, even if deemed retired, may continue with their membership with the cooperative if they so desire; and

- All other categories that the Board of Directors may decide on with the ratification of the General Assembly.

-

ASSOCIATE MEMBERSHIP - are officially enrolled students of Silliman University ages 18 years old and above ( no work yet)

-

AFFILIATE MEMBERSHIP - are Junior Depositors, 17 years old and below

- who are officially enrolled students of Silliman University; and

- Children of existing SUCC members even if not enrolled/students in the University

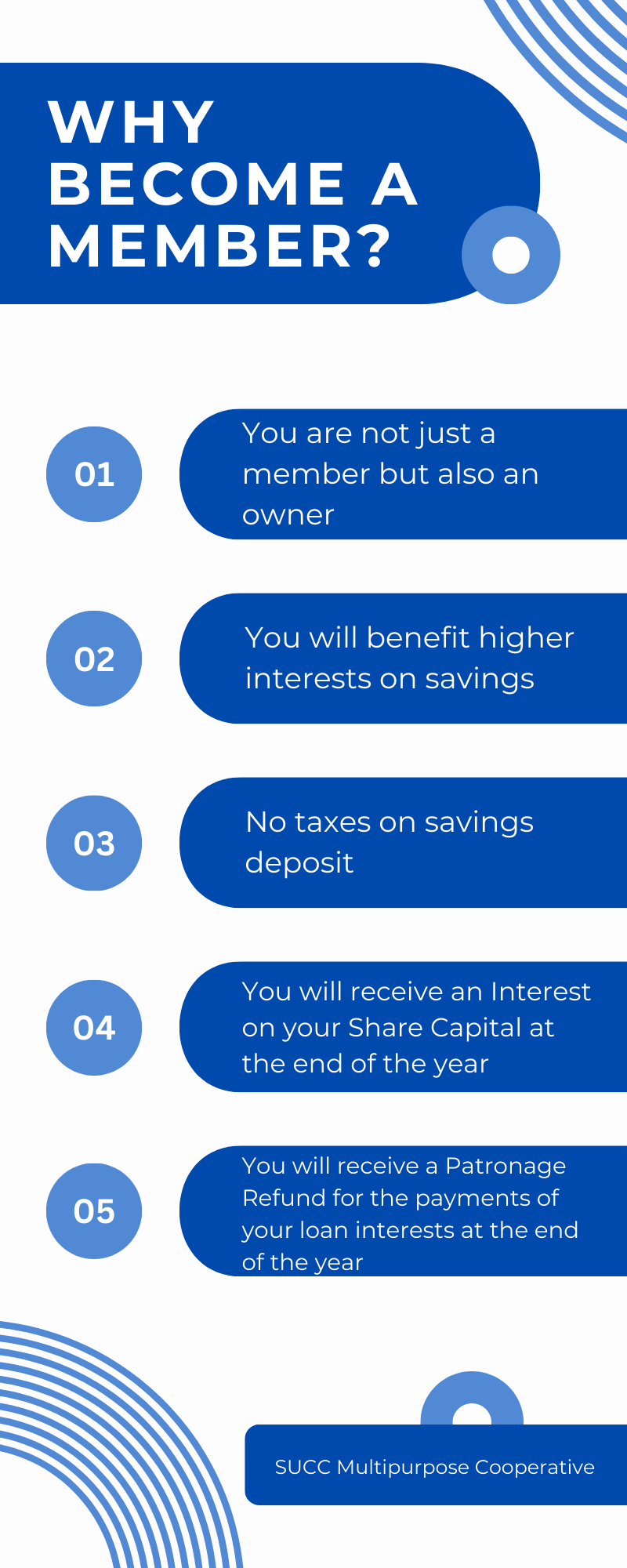

What are the benefits of a SUCC member?

-

SUCC Caring Fund (SCF)

- Maximum of Php10,000 financial assistance a month for those with Cancer, or a maximum total of P30,000 a year

- For other diseases*, financial assistance is one-fourth (1/4) of a member’s expense and maximum of Php10,000 a month, or Php30,000 a year

- Hospital bills/receipts with doctor’s medical certificate are required

- Must have paid at least 6 months prior to the claim

- One year contestability period

-

Social Service Fund (SSF)

- In case of member’s death

- free Memorial plan

- Cemetery lot at The Gardens

- Cash benefit as follows:

- Ten (10) years and more - Php200,000

- More than five (5) years up to ten (10) years - Php100,000

- Less than one (1) year up to five (5) years - Php 50,000

- In case of spouse/child’s death of a married member or death of the parent of a single member

- Php10,000.00 cash benefit each

SUCC Membership Category

-

Category 1 – Good Payor

- Consistently paying the required monthly loan amortization

- At least one (1) year for new members

- At least 3 months for current members

- Paying the minimum monthly contribution:

- Share Capital : Php200 - can be paid in advance

- Savings Deposit : Php100 – minimum only (can be higher amount)

- SUCC Caring Fund : Php150 - can be paid in advance

- Social Service Fund: Php200 - can be paid in advance

-

Category 2 – Semi-Good Payor

- Consistently paying at least 50% of the monthly amortization for at least 1 year

- No loan exceeding the maturity date

- Paying the minimum monthly contribution:

- Share Capital : Php200 - can be paid in advance

- Savings Deposit : Php100 – minimum only (can be higher amount)

- SUCC Caring Fund : Php150 - can be paid in advance

- Social Service Fund: Php200 - can be paid in advance

-

Category 3 – Non-MIGS

- Members not In Good Standing

- Members who are not patronizing the coop’s business within one year

- Members with at least 3 months default on their monthly amortization

- Loans have exceeded the maturity date

- Members paying less than 50% of the monthly loan amortization

-

Category 4 – Investor

- Any member who has not patronized of our loan services for at least a year

-

Category 5 – Newbie

- New member for at most one (1) year

-

Category 6 – Senior’s Privilege

- A SUCC member who is a pensioner no less than 60 years old with a senior citizens ID

- Share Capital has reached an amount at least P75,000.00 and above

- Monthly contributions (Share Capital and Savings Deposit) is not required to be paid monthly

- The retiree may opt to continue his/her category 1 status by paying the required monthly contribution

- To enjoy Category 1 privileges, the member must update Share Capital, Savings and loans, if any, from the time when he/she transferred to Category 6 up to present.